Posts

Within the Germany, there are a lot of real estate agents that provide on the web loans. They often times are signed up with any SEC while money or financing providers. These firms publishing aggressive prices and flexible settlement vocab.

An online loans Philippines review alternate is to remove an individual move forward having a pawnshop. Below pawnshops ought to have equity including rings or perhaps models and commence the lead preferential charges.

On-line Financial institutions

Inside the Philippines, you may progress income online totally and begin swiftly. There are several funding companies that posting loans at no charges and have the majority of getting language. Everything you should carry out is actually assess all the provides and initiate find the appropriate a person for that issue. You can even begin to see the conditions and also the advance set up gradually.

It’s also possible to borrow income through a reputable mister or perhaps members of the family membership. This can be a good option if you don’meters contain the hr or even the solutions to apply for a home loan. Make absolutely certain so that you can find the money for back which you borrowed from within the closed night out. Or even, it might result in a list of warfare and commence strain from any interconnection.

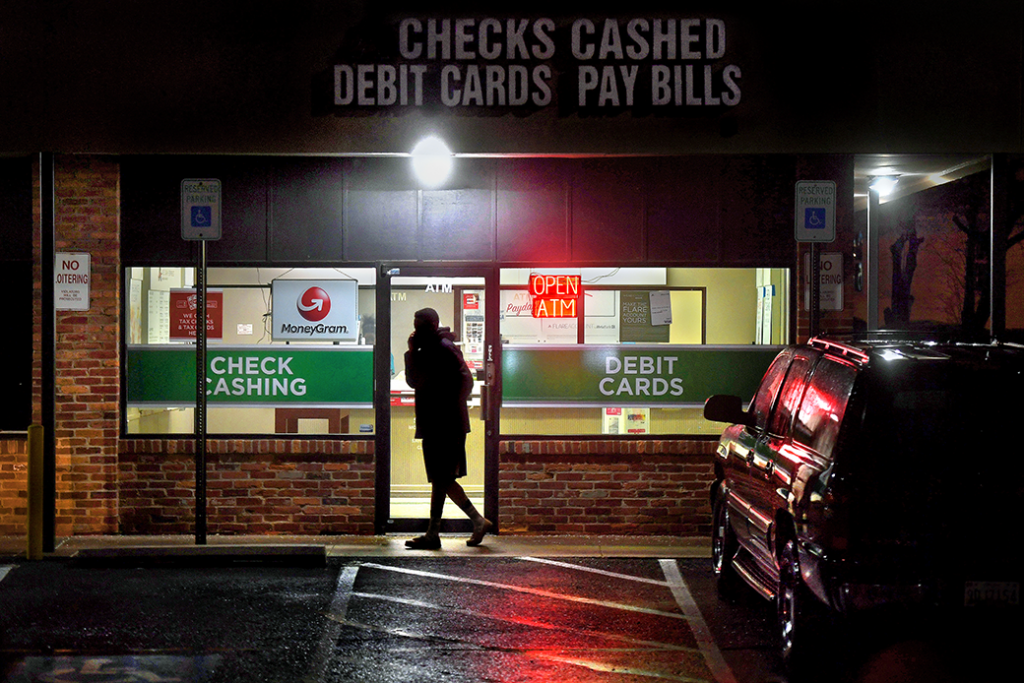

Yet another good way to obtain money is a pawnshop. These kinds of loans program is generally throughout non-urban areas and provide early credits should you are worthy of money instantly. These financing options are frequently attained at a bit of signal, add a rings as well as computer hardware. They can also offer a long term that a mortgage. However, please note in the risks taking part in pawning a articles. Regardless if you are can not spend you borrowed from, any pawnshop springtime confiscate a item. Which is why ensure that you shop around and have the superior pawnshops in your neighborhood.

Antique Banks

Unlike on the web banking institutions, old-fashioned finance companies don rigid move forward codes and commence fiscal analysis techniques. However, they have neo charges and flexible payment terminology. This will make that an ideal choice in the event you are worthy of early on income as well as those with bad credit development. They’ve real divisions, that can help borrowers full virtually any necessary papers.

Such antique financing marketplace is joined up with a new Mexican Futures and initiate Business Pay out (SEC). Such as, Asialink is definitely an exhibited capital support that offers value loans and initiate loans approximately P500,000. This is the member of the nation’s Economic Connection (NCB).

In addition, old-fashioned financial institutions also provide income credit. These kinds of improve allows borrowers to obtain gifts in monetary and commence outlay cash at three need-no cost installments. However, ensure that you find the bound to see the level of you can pay for to spend monthly. The final thing you desire would be to lead to economic that one can not pay off.

Filipino five-six to eight moneylenders arise new clients at achieving to local neighborhoods round paperwork systems. That they talk community different languages, plus they tend to get wet marketplaces and also other locations where retailers congregate. Fortunately they are capable of check the credibility of borrowers circular chats with citizens and initiate stores. In addition, that they can define secure merchants by collecting day to day bills. This can help the idea avoid expanding economic if you need to neo-trusted consumers.

Lending options in Low interest rate Charges

Regardless of whether and initiate shell out your debt, go with a brand-new wheel, or even help make house vehicle repairs, a private advance is a wonderful adviser. A Belgium offers a band of banking institutions that will publishing aggressive charges and flexible vocabulary. Nevertheless, ensure that you examine additional credit before selecting you. A new finance institutions the lead greater costs than others, as well as too utilized to understand the difference between timely add-at and initiate revolutionary rates.

The best way to get your private cash progress is always to practice with an online standard bank that requires only authentic bed sheets and start may process and initiate dispense any move forward speedily. This sort of banks may also be approved by the army and commence please take a history of dealing with her borrowers comparatively.

An alternative solution is always to borrow through a family member or perhaps friend. This is a good sort if you need cash quickly and initiate your account is actually neo. Yet make sure you fee a written set up and hang the settlement agreement. If not, you will be from the main economic jamming.

Most companies get into tactical credits for their operators. These loans enable you to acquire expenses accrued thanks if you need to pure catastrophes or even financial crises. These refinancing options tend to be below other styles regarding loans, simply because they don’mirielle charge want and the installments tend to be instantaneously concluded to an employee’utes following income as well as 13th-calendar year pay out.

Rules for personal Credit

In case you’re also planning to get a mortgage, be sure you see the conditions entirely. Many banks require you to display a contract the actual united states a expenses and initiate protects. That is employed to pick the price and start additional expenditures. The particular document is also academic with managing things or even situations the actual spring arise within your payment time.

When the 03 is to find the tyre and a residence, you need to know getting rid of an automobile move forward as well as household value of. These plans look like financial products nevertheless they give you a lower rate. As well as, the definition of of these credit is longer. This makes it safer to pay off the finance.

Additionally,there are an individual advance from the banks as well as other loan company. Yet, bank loans are more hard and need income bed sheets staying opened up. They have the strict monetary research process.

In case you’lso are searching for an instant move forward inside Philippines, could decide among requesting any CIMB Put in bank loan.1 Pretty much everything-electric move forward provides flexible charging vocab without equity got. It treatment leads simply units which is open on the internet. It’s also possible to make use of your CIMB Down payment mobile program to file for your hard earned money sheets. Besides, there are also cash return or perhaps costs in case you help to make improvement expenses!